ClearBlue Markets

Making Carbon Markets Work For You

ClearBlue Markets helps companies engage with compliance and voluntary carbon markets worldwide to achieve decarbonization goals with maximum financial benefit.

New Product Release:

Vantage Position Optimization "Executive View" Dashboard

Designed specifically for the C-suite, this update transforms complex, fragmented regulatory data into a unified financial picture, enabling leadership to manage carbon liabilities with the same clarity as other major forms of financial exposure.

ClearBlue Launches CBAM Market Insights to Help Businesses Navigate New EU Carbon Border Regulations

Designed to help companies navigate the complexities of the European Union’s Carbon Border Adjustment Mechanism (CBAM), the new service provides exporters and EU importers with the tools to track market trends and predict their obligations.

ClearBlue Expands VCM Market Intelligence with Enhanced Offset Price Discovery Tool

For investors, traders, developers, and corporations, these improvements translate into stronger risk management, fairer negotiations, and more accurate valuations.

vantage carbon intelligence

Navigate the Carbon Markets With a Trusted Guide

The Vantage carbon intelligence platform provides users with a centralized, reliable source of information, allowing them to confidently navigate carbon markets and make optimal decisions.

Three Decision-Useful Modules:

- Market Intelligence: Gain comprehensive market insights for compliance and voluntary strategies.

- Position Manager: Monitor and manage your emissions position, both current and future.

- Voluntary Offset Insight: Leverage our AI-backed tools to gain clear insights into credit pricing and market trends

Who We work with

Clearblue Services

Dynamic Solutions for Carbon Market Success

We offer clients expert guidance across four crucial domains, delivering cost-effective and timely strategies to achieve compliance and voluntary carbon market targets.

Market Intelligence

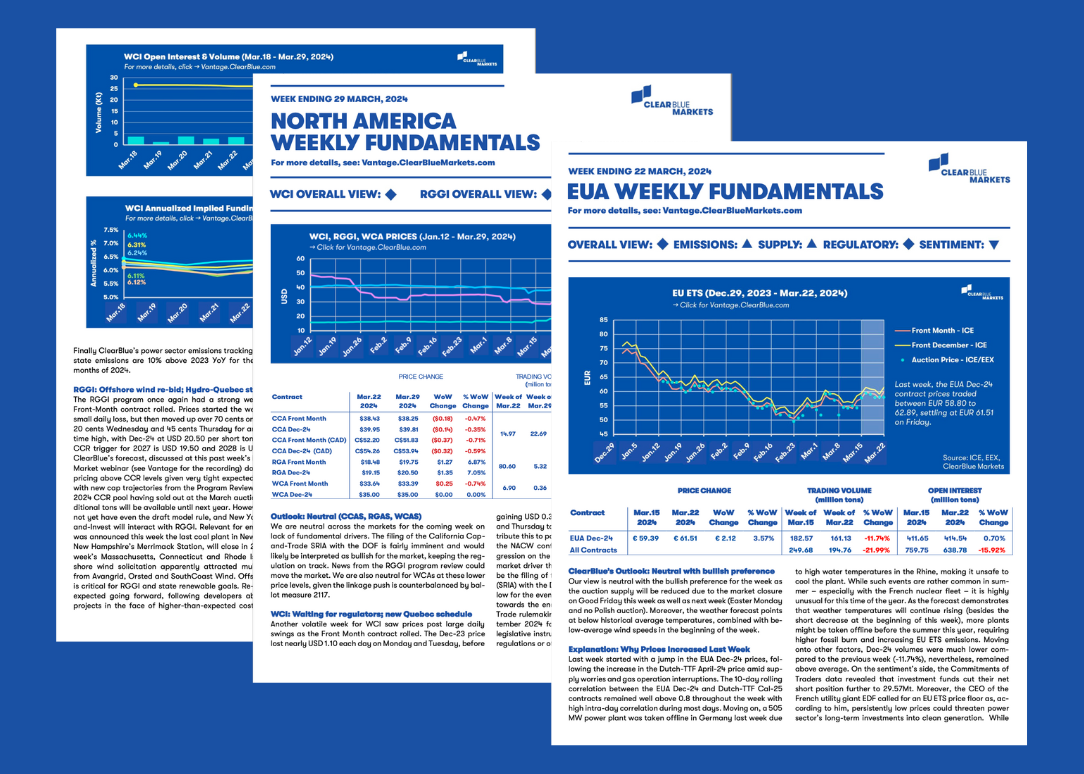

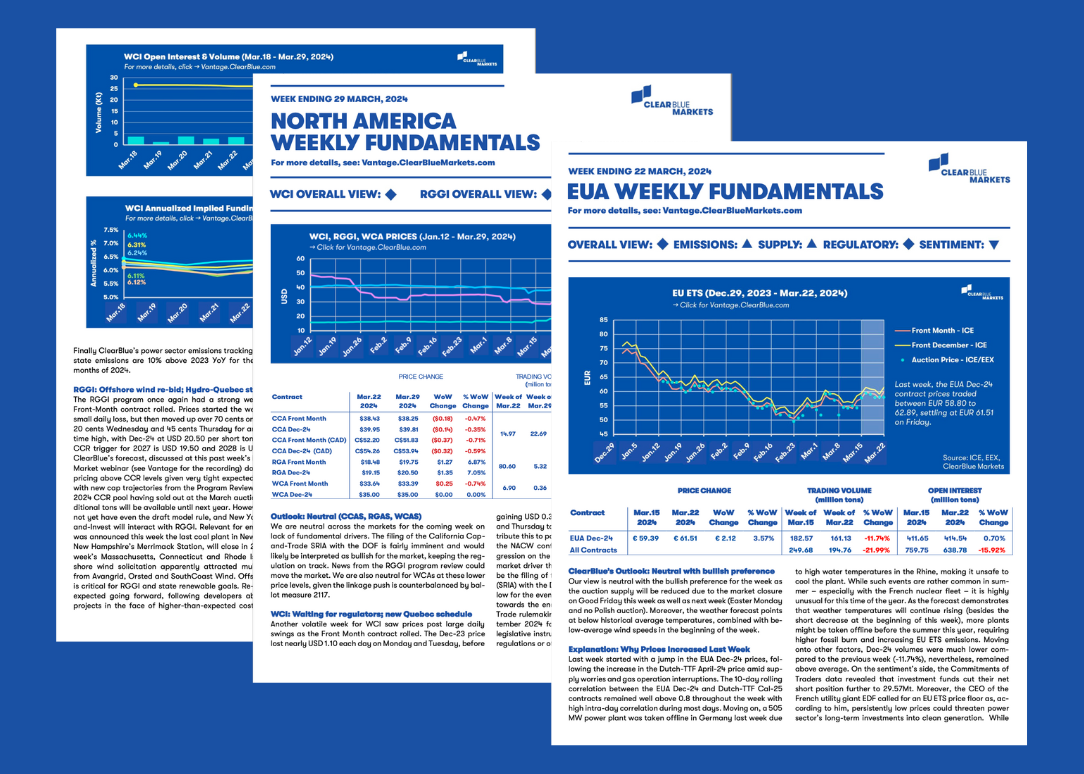

Market Intelligence subscribers benefit from timely updates on supply-demand drivers, regulatory developments, and emissions indicators, along with pricing outlooks across established and emerging carbon markets.

Advisory Services

Advisory clients receive expert, hands-on support in carbon pricing strategy, position management, cost optimization, and credit procurement across compliance and voluntary carbon markets.

Market Access

Our transaction experts maximize clients' exposure while minimizing risks by offering access to premium credits and employing effective trading strategies.

Project Development

From project inception to commercialization, developers of carbon offsets, fuel credits, nature-based credits, and other instruments receive comprehensive guidance, addressing all technical, regulatory, and legal challenges.Market Intelligence

Market Intelligence subscribers benefit from timely updates on supply-demand drivers, regulatory developments, and emissions indicators, along with pricing outlooks across established and emerging carbon markets.

Advisory Services

Advisory clients receive expert, hands-on support in carbon pricing strategy, position management, cost optimization, and credit procurement across compliance and voluntary carbon markets.

Market Access

Our transaction experts maximize clients' exposure while minimizing risks by offering access to premium credits and employing effective trading strategies.

Project Development

From project inception to commercialization, developers of carbon offsets, fuel credits, nature-based credits, and other instruments receive comprehensive guidance, addressing all technical, regulatory, and legal challenges.

Environmental Finance Market Rankings

Award-Winning Team and Services

The Environmental Finance rankings are an annual barometer of the market, where industry participants cast their votes for the companies and initiatives showcasing best practices and innovation. We are the proud recipient of 27 of these top-ranking awards for multiple countries around the world.

Compliance Market Awards

We've earned "Best Advisory or Consultancy" in the Environmental Finance Market Rankings 23 times since 2017, highlighting our exceptional support in North America, Europe, California and China.

.png?width=150&height=102&name=VCMR25-LOGO-WIN-CLEARBLUE%20(002).png)

Voluntary Market Awards

We've been voted "Best Advisory or Consultancy" for four consecutive years in the Environmental Finance Voluntary Carbon Market Rankings.

our partners

Synergy. Efficiency. Impact.

ClearBlue Markets collaborates with like-minded organizations to propel sustainability initiatives forward, leveraging collective expertise and resources to amplify impact and drive meaningful change.

RBC's investment in ClearBlue Markets' Series A financing fuels the expansion of our carbon intelligence platform, ClearBlue Vantage.

As the carbon neutrality partner for Decarb Connect's 2024 conference series, ClearBlue Markets expertly tracks and offsets emissions for virtual and in-person events, helping attendees achieve a cleaner, greener future.

Our collaboration blends Deloitte's advisory and technology strengths with ClearBlue's expertise in carbon markets. Together, we empower clients to effectively navigate carbon compliance and meet their net-zero goals.

Membership Associations

Advocacy and Representation

ClearBlue aligns with leading environmental and energy organizations committed to driving sustainability and innovation forward. We advocate for policies and initiatives that benefit the industry, representing the collective voice of our clients to governments, regulatory bodies, and other stakeholders.

Championing the power of high-integrity markets to reach net-zero targets

.png?width=100&height=50&name=Untitled%20design%20(67).png)

Representing companies engaged in environmental market trading, legislation, and regulation

The leading voice for Ontario's clean technology sector

Representing the business sector of Quebec on issues related to environment and sustainable development

Uniting Colombian carbon market actors

.png?width=100&height=50&name=Untitled%20design%20(68).png)

Supporting the diverse needs of the biogas and renewable natural gas (RNG) sector in Canada

Key Performance Indicators

These metrics underscore our dedication to excellence and leadership within the carbon markets

-

90 %CLIENT RETENTIONWe have maintained a 90% client retention rate since our inception in 2016

-

66MethodologiesCollectively, our team has developed over 66 methodologies for quantifying and verifying emission reductions or removals

-

85YearsOur leadership team boasts a collective 85 years of experience in carbon markets

-

350,000,000tonnesOver 350 million tons of carbon dioxide equivalent (tCO2e) compliance program positions are overseen and hosted on Vantage.

Articles, Blogs, Reports, and News Updates

Featured Resources

Get to know us. Explore articles, blog posts, reports, and webinars that showcase our thought leadership.

Newfoundland and Labrador See Emissions Exceed Limit for the First Time

January 30, 2026Newfoundland recently published their 2024 annual outcome report, seeing emissions exceed the cumulative emissions limit for the first time since the programs inception.

The State of Global Carbon Markets in Q4 2025: Value and Volatility

January 29, 2026This edition reviews the regulatory catalysts and supply-demand fundamentals that defined the carbon markets as we headed into the new year.

Webinar Recap: How 2025 Became the Breakout Year for Carbon Price Discovery

January 29, 2026Here are the key takeaways from the session, including insights from the audience Q&A.

FREE NEWSLETTER

Weekly Market Insights

Our free Week In Review newsletter shares key insights sourced from our weekly paid subscriptions, giving you an overview of pricing trends and regulatory developments across North American and European compliance and voluntary carbon markets.