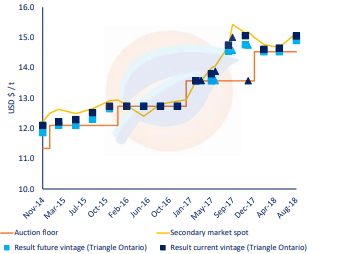

The highly anticipated WCI Auction #16 result was oversubscribed for both current and future vintage allowances. This auction was the first California/Quebec joint auction after Ontario departed the market, and saw for the fourth time since last November previously unsold allowances offered for sale. Current vintage allowances cleared at $15.05, $0.52 above the auction floor price and $0.10 below the secondary market on the day prior to the auction. It was also oversubscribed with an auction cover ratio of 122%, meaning that 17.5M bids were not filled. The future vintage auction was even more oversubscribed with a record auction cover ratio of 145%, meaning 4.2M bids were not filled, which was the highest level since August 2017. In terms of participants, 87 entities qualified for bidding and 7 companies participated for the first time. Qualified bidders increased compared to the previous auctions, where a total of 81 (excluding Ontario) companies successfully qualified.

The Ontario Delinkage effect now seems to be behind us and California and Quebec entities are confident in the future of the market. Overall, this auction result will be considered strong by the market and shows in our opinion that market participants, and especially more sophisticated players (most likely in California), continued to increase their hedging.

The original summary report can be found here