San Francisco, 24 May (Argus) — The latest results from the Western Climate Initiative (WCI) carbon allowance auction indicate that industry officials are betting on the survival of Ontario's cap-and-trade program.

The province, along with California and Quebec, sold all of the nearly 90.6mn vintage 2016 and 2018 allowances offered at a 15 May auction, according to results released yesterday by the state and provincial governments.

That high level of demand at the auction comes just ahead of a 7 June election that could upend the nascent carbon market alliance. The opposition Progressive Conservative Party has threatened to do away with the cap-and-trade program if it takes over as the majority government.

"Despite the political uncertainty, Ontario entities are not really shying away," said Nicolas Girod of the carbon market advisory firm ClearBlue Markets.

Ontario started its carbon market in 2017 and linked with the California and Quebec programs this year, significantly expanding the market and adding to the number of trading partners available to companies.

Girod noted that 45 Ontario companies qualified for bidding in the latest auction, 10 more than in February.

Numbers like that suggest that Doug Ford, leader of Ontario's Progressive Conservative Party, could find it difficult to disentangle the province from a climate policy that industry has already invested in. More interests than ever have committed to the program, at least for the next two years covered by the current vintage allowances sold at this week's auction.

Former environment minister Glen Murray, who oversaw the creation of Ontario's cap-and-trade system, has said that it will be "almost impossible" for someone to undo the program and warned they would "pay a very difficult price" to do it.

Key components of the province's climate strategy and market structure are enshrined in legislation and could be particularly difficult to repeal.

But not all market signals suggest widespread optimism about prospects for Ontario's carbon market. A carbon trader for one California fuel wholesaler said that market participants had already accounted for the possibility of Ontario's departure well before the event.

"With the December 2018 futures trading down to $15, we priced in most of the risk already."

The price for vintage 2018 CCAs with a December delivery had dropped more than 40¢ since 1 January 2018 by the time of the May auction. The vintage 2018 CCAs for December delivery received a slight bump from the auction results, trading for $15.14/t yesterday.

Environmental groups, concerned that the most ambitious carbon pricing program in North America might falter, nonetheless breathed a sigh of relief yesterday.

"The results for both current and future vintage in this auction indicate that confidence is steady, and the California-Quebec-Ontario market remains a world leader in driving climate action," Environmental Defense Fund senior analyst Katelyn Roedner Sutter said.

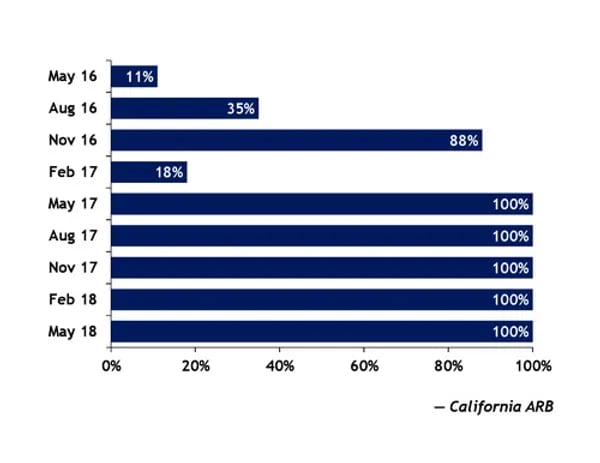

The last five quarterly auctions, dating back to May 2017, have sold out of the current vintage allowances offered — a period of stability that has provided regulators with a steady source of revenue to fund climate change mitigation projects.

Doug Ford says he is determined to "scrap" the cap-and-trade program. But as the latest auction results indicate, he would have to overcome a growing constituency of support for the fledgling market to make good on that campaign pledge.

2015 GHG emissions by jurisdiction mn t

CCA auctions: Percentage of current vintages sold

Read original article here