Navigating the complexities of carbon markets just got easier! We're thrilled to announce the launch of Vantage Position Optimization, a new solution within our ClearBlue Vantage platform designed to empower compliance carbon market participants. Read our news release here.

This powerful tool offers proprietary scenario forecasting and jurisdictional aggregation capabilities, addressing a critical need for streamlined and strategic carbon portfolio management. By addressing critical gaps in carbon market intelligence, Vantage enables informed, strategic decision-making in an evolving global landscape.

What is Vantage Position Optimization?

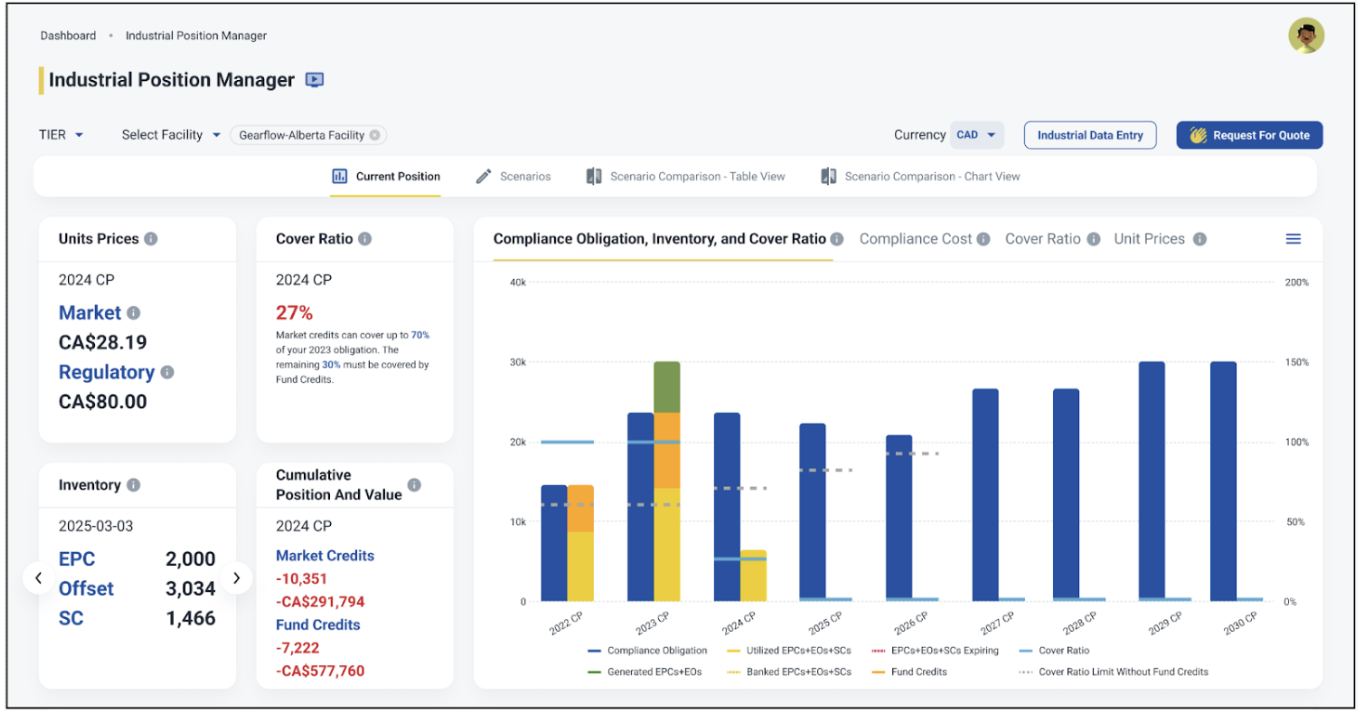

Vantage Position Optimization empowers carbon market participants to bolster strategy, manage risk, and streamline reporting—all within a scalable, tech-enabled platform. Integrated into ClearBlue Vantage, our AI-driven carbon intelligence platform, it brings together market intelligence, risk reports, advisory, transaction support, and compliance reporting into one powerful solution.

Addressing Key Challenges

One of the biggest challenges companies face when managing carbon portfolios is the lack of centralized price and market data, making informed investment decisions difficult. Vantage Position Optimization addresses this challenge head-on. This all-in-one platform enables forecasting of financial exposure due to market volatility, provides a unified view of compliance obligations across jurisdictions, and grants access to the market intelligence needed to navigate regulatory complexities.

Key Features and Benefits

ClearBlue’s platform offers two stand-out advantages over other products in the market:

Compliance Market Scenarios:- Allows users to model production, emissions, transaction activity, and price volatility to compare different strategies within a sandbox environment, enabling predictive scenario modeling for strategic compliance and financial forecasting.

- More than just a forecasting tool—it’s a risk management solution designed to help clients navigate market volatility and regulatory uncertainty. By modeling various outcomes based on production changes, emissions variations, transaction activity, and price volatility, clients can proactively assess financial exposure and adjust their strategies accordingly.

- Beyond risk mitigation, scenarios drive smarter strategic decision-making by identifying high-return opportunities in energy transition. Whether it’s optimizing investments in low-carbon technologies, evaluating the impact of carbon pricing changes, or assessing market-based compliance strategies, this tool provides data-driven insights to guide clients on where to invest for maximum return.

- With an easy user interface, enhanced visualization capabilities, and a more intuitive comparison framework, clients can easily test multiple market scenarios —enabling faster, stronger, and more confident decisions.

- A first-of-its-kind solution that provides a holistic, overarching-market perspective by aggregating facility-level data into a unified dashboard, enabling multi-facility clients to efficiently monitor and manage the entirety of their compliance obligations.

- Traditionally, companies have been forced to track compliance in a segregated manner, leading to inefficiencies, inconsistencies, and an incomplete view of their financial exposure.

- With a like-for-like comparison across regulatory frameworks, ClearBlue clients can now evaluate historical trends, forecasted obligations, and financial risks across their entire operation—all in one place.

Market Availability

Vantage Position Optimization is currently available to companies under Ontario’s Emissions Performance Standards (EPS) program, the Western Climate Initiative's (WCI) Quebec participants, and the Alberta Technology Innovation and Emission Reduction (TIER) program. We will be adding additional key markets in North America, Europe, and the U.K. in a phased rollout through the remainder of 2025, starting with WCI California.

Learn More

Contact us using this form to see Vantage Position Optimization in action, or for more information on working with ClearBlue Markets.